Forex Brokers: Essential Tips for Maximizing Your Trading Potential

Forex Brokers: Essential Tips for Maximizing Your Trading Potential

Blog Article

Navigating the Complexities of Forex Trading: How Brokers Can Help You Stay Informed and Make Informed Decisions

In the fast-paced globe of foreign exchange trading, remaining informed and making well-informed decisions is vital for success. Brokers play a critical role in this intricate landscape, offering competence and support to browse the complexities of the market. Just how precisely do brokers help traders in remaining ahead of the curve and making educated options? By discovering the means brokers offer market analysis, understandings, danger management approaches, and technical tools, investors can obtain a much deeper understanding of exactly how to efficiently leverage these sources to their advantage.

Function of Brokers in Foreign Exchange Trading

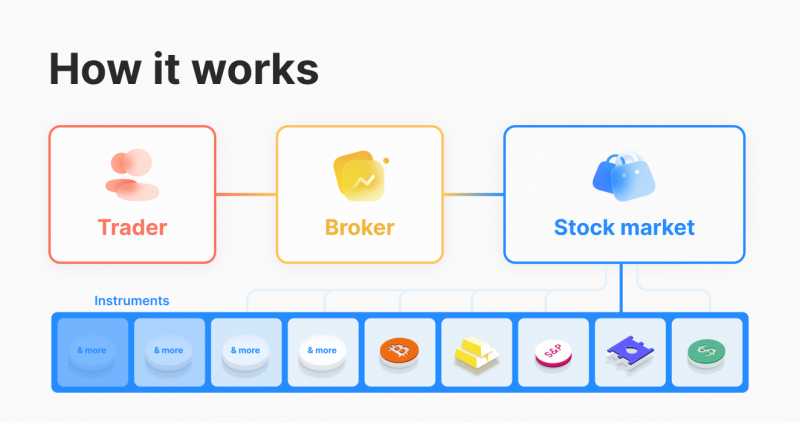

In the realm of Foreign exchange trading, brokers play a pivotal duty as intermediaries helping with purchases between investors and the worldwide money market. forex brokers. These financial experts work as a bridge, linking individual traders with the huge and complex globe of foreign exchange. Brokers offer a system for investors to access the market, offering tools, resources, and market understandings to aid in making notified trading choices

Via the broker's trading system, investors can get and offer currency sets in real-time, taking benefit of market changes. This function can enhance both profits and losses, making risk monitoring a critical facet of trading with brokers.

In addition, brokers supply useful academic resources and market evaluation to aid traders navigate the intricacies of Forex trading. By staying educated regarding market trends, financial indications, and geopolitical events, traders can make strategic choices with the support and support of their brokers.

Market Evaluation and Insights

Offering a deep study market fads and using important understandings, brokers furnish traders with the essential tools to browse the elaborate landscape of Foreign exchange trading. Market evaluation is an important facet of Forex trading, as it entails checking out various variables that can influence money price motions. Brokers play a pivotal function in this by giving traders with current market analysis and understandings based upon their expertise and research study.

Via technical analysis, brokers assist investors comprehend historic rate data, determine patterns, and forecast potential future cost activities. In addition, essential evaluation permits brokers to evaluate economic signs, geopolitical occasions, and market news to evaluate their influence on currency values. By manufacturing this details, brokers can offer traders useful understandings right into potential trading chances and dangers.

In addition, brokers frequently supply market records, e-newsletters, and real-time updates to maintain investors educated concerning the latest developments in the Foreign exchange market. This continual circulation of details enables traders to make well-informed decisions and adapt their techniques to altering market conditions. In general, market analysis and insights provided by brokers are vital tools that equip traders to navigate the vibrant globe of Forex trading successfully.

Danger Administration Methods

Navigating the unstable terrain of Forex trading requires the execution of durable threat monitoring strategies. Worldwide of Forex, where market fluctuations can happen in the blink of an eye, having a strong threat monitoring strategy is crucial to safeguarding your investments. One key strategy is establishing stop-loss orders to instantly shut a profession when it reaches a particular unfavorable rate, restricting possible losses. Furthermore, diversifying your portfolio throughout various money pairs and property courses can assist spread threat and shield versus significant losses from a single profession.

One more important threat administration method is proper placement sizing (forex brokers). By very carefully identifying the quantity of funding to risk on each sell proportion to the size of your trading account, you can protect against devastating losses that might eliminate your whole investment. Moreover, staying educated regarding international economic occasions and market news can assist you prepare for prospective risks and readjust your trading approaches accordingly. Ultimately, a regimented strategy to take the chance of management is important for lasting success in Foreign exchange trading.

Leveraging Modern Technology for Trading

To successfully navigate the intricacies of Forex trading, utilizing innovative technical tools and systems is necessary for optimizing trading strategies and decision-making procedures. One of the crucial technological advancements that find out here now have actually transformed the Forex trading landscape is the growth of trading platforms.

Moreover, algorithmic trading, additionally understood as automated trading, has actually ended up being significantly popular in the Forex market. By utilizing formulas to assess market problems and execute trades immediately, traders can get rid of human feelings from the decision-making procedure and take advantage of opportunities that develop within nanoseconds.

In addition, using mobile trading applications has actually encouraged investors to stay connected to the market whatsoever times, enabling them to monitor their settings, get notifies, and location trades on the go. In general, leveraging modern technology in Foreign exchange trading not just enhances efficiency yet additionally gives investors with beneficial understandings and devices to make informed decisions in a highly competitive market setting.

Creating a Trading Strategy

Crafting a distinct trading plan is important for visit their website Forex traders intending to browse the intricacies of the market with precision and strategic insight. A trading plan acts as a roadmap that outlines an investor's goals, risk tolerance, trading approaches, and technique to decision-making. It assists traders keep technique, handle emotions, and remain focused on their purposes in the middle of the ever-changing dynamics of the Foreign exchange market.

Conclusion

Finally, brokers play a critical duty in helping investors navigate the intricacies of foreign exchange trading by providing market analysis, understandings, threat management methods, and leveraging modern technology for trading. Their expertise and assistance can help investors in making educated choices and developing effective trading plans. forex brokers. By dealing with brokers, investors can visit here remain educated and raise their chances of success in the forex market

Report this page